Seasonal Tax Preparation: How to Get Ready for Tax Season in Atlanta

Understanding the Basics of Tax Preparation

As the leaves begin to change and the air turns crisp in Atlanta, it’s not just a sign of fall—it's also a reminder that tax season is right around the corner. Preparing your taxes can be a daunting task, but with the right strategy, it doesn't have to be. Understanding the basics of tax preparation is crucial for a smooth tax season. It involves organizing your financial documents, keeping track of deadlines, and understanding any applicable tax laws or changes that might affect your filings.

Gathering Necessary Documents

The first step in tax preparation is gathering all necessary documents. This includes W-2s, 1099s, mortgage interest statements, and any other forms that report income or deductions. Keeping these documents organized in a dedicated folder can save you a lot of hassle when it's time to file.

Additionally, if you have made any charitable donations, bought or sold property, or incurred significant medical expenses, make sure to have the appropriate documentation ready. These can significantly impact your tax return, potentially leading to deductions or credits.

Utilizing Tax Software or Professional Help

In today's digital age, there are numerous tax software options available that can simplify the process. These programs guide you through your tax return step-by-step and help ensure you don’t miss any crucial details. However, if your tax situation is more complex, hiring a professional might be beneficial. An experienced tax preparer in Atlanta can offer personalized advice and potentially save you money by identifying deductions or credits you might not be aware of.

Understanding Atlanta-Specific Tax Considerations

Atlanta residents may have specific state and local tax considerations to keep in mind. It's important to stay informed about any recent changes in Georgia's tax laws that could impact your filing. For instance, understanding the state's tax brackets and any available credits can be beneficial in maximizing your return.

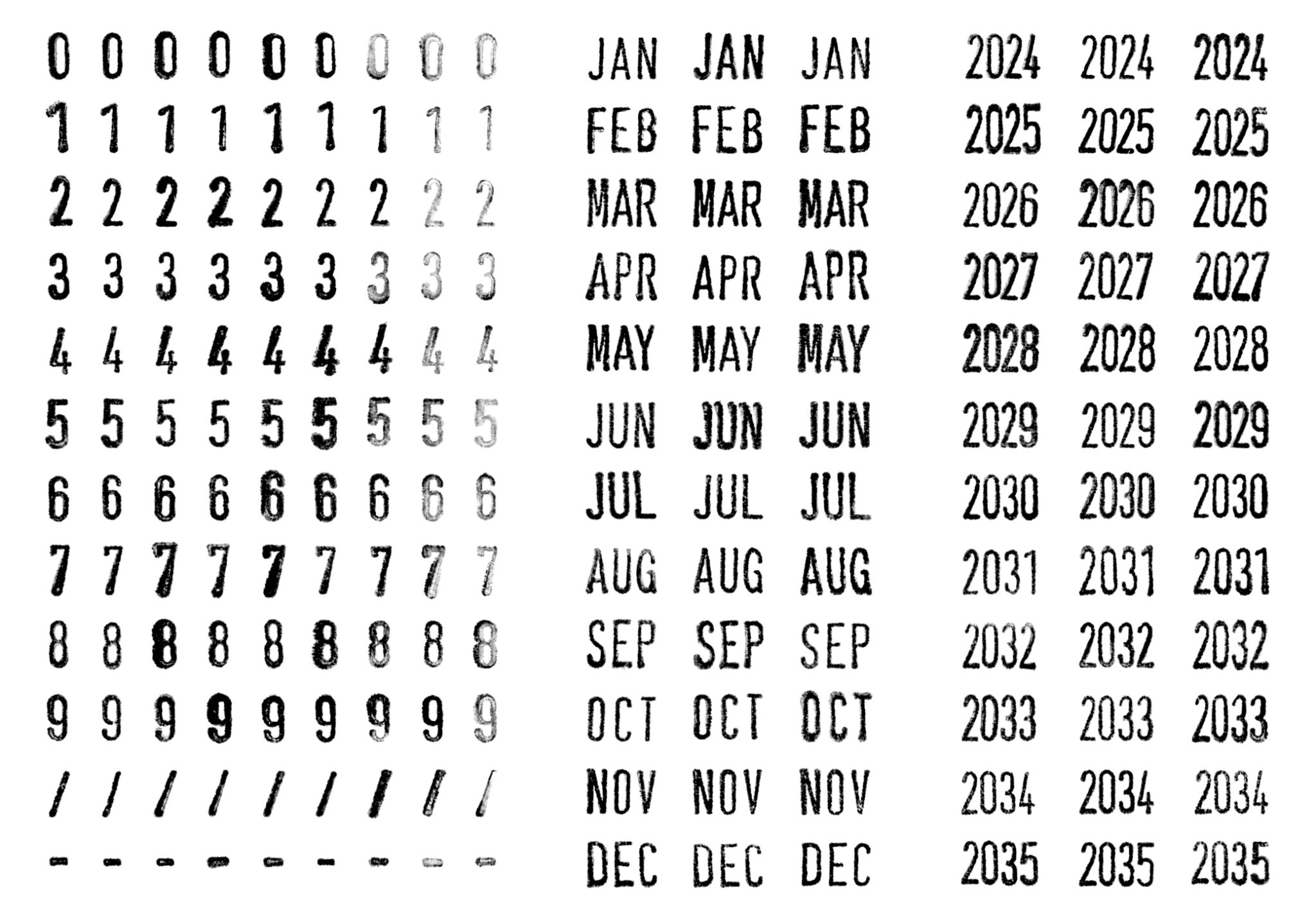

Creating a Tax Preparation Timeline

Creating a timeline can help manage the stress associated with tax preparation. Start by marking important dates, such as when you expect to receive all necessary documents and when you plan to begin preparing your taxes. If you're using a tax preparer, schedule an appointment well in advance of the deadline to ensure ample time for review and filing.

Reviewing Last Year’s Tax Return

Reviewing last year’s tax return can provide valuable insights into what you might expect for the upcoming season. It can serve as a checklist for the documents you need and remind you of any deductions or credits you claimed previously. This can also help identify any significant changes in your financial situation that may affect this year’s taxes.

Staying Aware of Deadlines

One of the most critical aspects of tax preparation is being aware of deadlines. The federal tax return deadline is typically April 15th; however, it’s important to check for any changes that could affect this date. Georgia might also have specific deadlines for state taxes that differ from federal deadlines.

Always plan to file well before these deadlines to avoid last-minute stress and potential penalties for late filing.